Defer

Deferring taxes preserves capital,

giving you more to reinvest

Deferral as a tax strategy

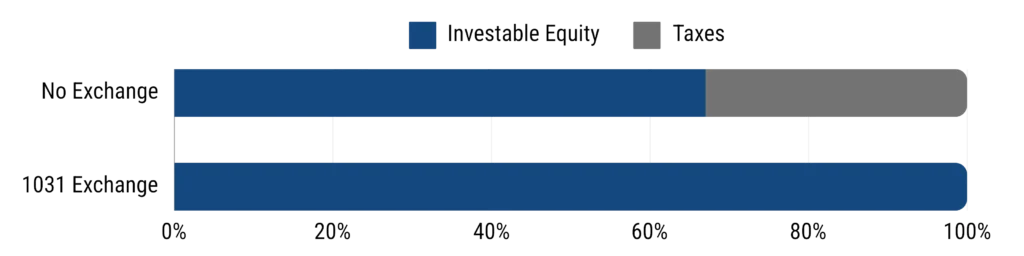

Deferring taxes through a 1031 exchange is a powerful way to preserve and grow your wealth. When you sell investment property without a 1031 exchange, you could face hefty capital gains taxes—sometimes more than 30% of your profits—drastically reducing the amount of money available to reinvest. However, by completing a 1031 exchange, you can defer those taxes and reinvest the full value of your property into new, diversified real estate assets. This not only maximizes your buying power but also allows you to strategically spread your risk across different property types and markets, enhancing your portfolio’s stability and potential for long-term growth. The ability to defer taxes while diversifying is key to compounding your wealth, protecting it from market fluctuations, and ensuring a more secure financial future.

Tax Liability Breakdown

- Federal Capital Gains Tax

- State Capital Gains Tax

- Depreciation Recapture

- Net Investment Income Tax (NIIT)

- Other/Transfer Taxes

Tax liabilities typically range from 30% to 40% of the sales proceeds for most investment real estate.

This illustration represents a hypothetical tax deferral. The estimations are generalized and intended to demonstrate common scenarios which may be considered as part of a tax deferral strategy.

Advantages / Risks

- Tax Deferral: You can defer capital gains taxes, allowing you to reinvest the full proceeds from the sale into new investments.

- Increased Buying Power: With no immediate tax burden, you have more equity to acquire higher-value or more desirable properties.

- Portfolio Diversification: You can exchange into different types of properties (e.g., from residential to commercial) or into multiple properties to reduce risk.

- Consolidation or Segmentation: Offers the flexibility to consolidate multiple properties into one or split one property into several for strategic reasons.

- Wealth Building and Compounding: By deferring taxes through multiple exchanges, investors can grow their portfolio more effectively over time.

- Estate Planning Benefits: If heirs inherit the property, they may receive a stepped-up basis, effectively eliminating the deferred tax liability.

- Strict Time Constraints: You must identify replacement properties within 45 days and close within 180 days, which can add pressure.

- Limited Flexibility: The exchange must be “like-kind,” meaning there are limitations on what types of properties qualify.

- Potential for Higher Fees: Legal, intermediary, and transaction fees can accumulate, reducing some of the financial benefit.

- Market Timing Risk: You may feel rushed to reinvest in a market that isn’t favorable, increasing the chance of overpaying.

- Complex Process: Requires careful planning and coordination with intermediaries and tax professionals, increasing complexity.

- Deferred Taxes Are Not Eliminated: Taxes are only postponed, not erased – eventually, they will be due unless passed down with a stepped-up basis.