Diversify

Move from active management

to passive income

Diversification as an investment strategy

Diversification is a key strategy for protecting and growing your wealth, especially when it comes to real estate investments. By spreading your assets across different types of properties—whether it’s commercial, multifamily, or industrial—you reduce the risk of being overly exposed to any single market or economic changes. A 1031 exchange not only allows you to defer capital gains taxes but also provides an ideal opportunity to diversify your portfolio without losing a significant portion of your profits to taxes. Instead of reinvesting all your equity into one property, you can strategically allocate it across multiple assets, each with its own income stream and growth potential. This approach not only enhances stability but also positions you to weather market fluctuations, maximizing long-term returns and ensuring consistent cash flow. Diversifying through a 1031 exchange is a smart move for those looking to build a resilient financial legacy.

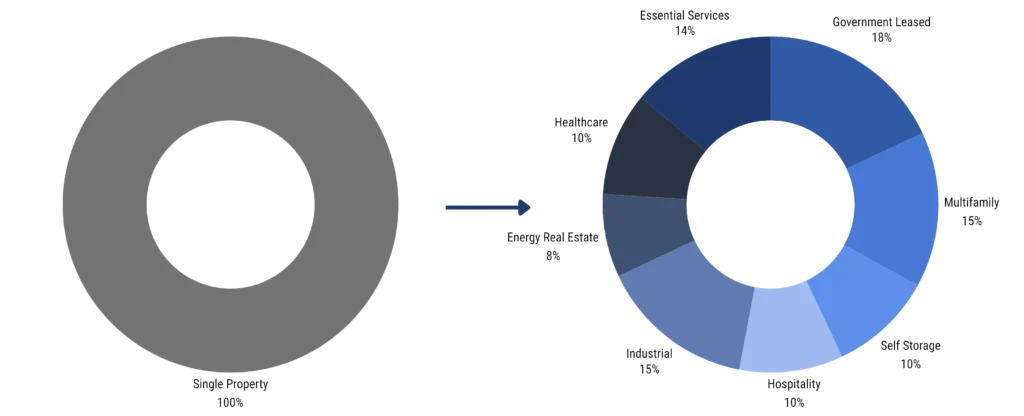

This illustration represents a hypothetical transition into a diversified portfolio. The asset allocations are generalized and intended to demonstrate the types of investments that may be considered as part of a diversified strategy.

Advantages / Risks

- Access Institutional-Grade Assets: Invest in high-quality real estate across various sectors, including multifamily, office, retail, and industrial properties.

- Reduce Investment Risk: Spread your investments across different property types and locations to create a balanced, diversified portfolio that mitigates risk.

- Tailored to Your Goals: Customize your real estate holdings to align with your financial objectives, such as growth, income, or a mix of both.

- Strategic Liquidity Events: Plan liquidity based on your future needs by staggering property investments, giving you access to funds at key milestones.

- Flexibility for Retirement: Create a laddered liquidity schedule that provides predictable income during retirement or significant life events.

- Balance Stability and Access: Enjoy both the stability of long-term real estate investments and the flexibility to access capital when needed.

- Defer Capital Gains Taxes: Utilize 1031 exchanges to reinvest in real estate and defer capital gains taxes, maximizing your investment potential.

- Preserve More Equity: Protect your profits from immediate taxation, allowing you to reinvest and grow your portfolio more effectively.

- Optimize Investment Timing: Defer tax obligations until the right time for you or your estate, enhancing control over your financial planning.

- Preserve Wealth for Future Generations: Ensure your real estate assets are structured to pass on to heirs in a tax-efficient manner, protecting your family’s financial future.

- Tax-Efficient Wealth Transfer: Utilize 1031 exchange strategies and estate planning tools to reduce or eliminate estate taxes, safeguarding your legacy.

- Customized Legacy Planning: Tailor a real estate strategy that aligns with your personal values and financial goals, securing your family’s long-term prosperity.

Utilize our portfolio diversification tool here